In the ever-evolving landscape of economic forecasts, the recent discourse surrounding inflation and interest rates has captured the attention of investors and consumers alike. Cleveland Fed president Loretta Mester, renowned for her astute observations, shared her perspective in an exclusive interview with Yahoo Finance.

Despite the latest inflation figures, Mester remains steadfast in her anticipation of three rate cuts later in the year. She asserts that while the recent uptick in inflation warrants attention, it does not deter her conviction that inflation will gradually recede towards the Federal Reserve's 2% target over time.

The Current Landscape

Instagram | federalreserveboard | The price increases stayed below the Fed's 2% target for six consecutive months.

As Mester delved into the intricacies of the economic landscape, she emphasized the significance of the core Personal Consumption Expenditures (PCE) index, a vital metric monitored by the central bank. Notably, while the annual increase in the core PCE index for January marked a modest 2.8%, the month-over-month surge of 0.4% signaled a noteworthy departure from previous trends.

Prior to this, the six-month annualized rate of price increases had languished below the Fed's 2% target for consecutive months, only to rebound to 2.5% following the January data release.

Navigating Uncertainty

Amidst this backdrop of fluctuating indicators, Mester maintains her stance on the necessity of three rate cuts in 2024, a forecast she articulated as early as December. Her conviction stems from a holistic evaluation of economic fundamentals, where solid growth and a robust job market provide a foundation for cautious optimism.

Emphasizing the importance of patience, Mester asserts that the Federal Reserve has the latitude to carefully monitor economic developments and adjust policy accordingly. This sentiment resonates with her colleagues, including Fed Chair Jerome Powell, who advocates for a measured approach amidst volatile economic conditions.

Instagram | infocryptovn | Loretta Mester, President of the Federal Reserve Bank of Cleveland.

Challenges and Opportunities

While Mester acknowledges the challenges posed by recent inflationary pressures, she remains optimistic about the prospects of moderation. High interest rates, coupled with prudent consumer spending and a decline in business investment, are indicative of a natural cooling effect on the economy. As growth moderates, Mester anticipates a gradual normalization that will ultimately alleviate inflationary pressures and pave the way for sustained economic stability.

Insights from Fellow Fed Officials

Mester's insights are echoed by her peers within the Federal Reserve, notably Atlanta Fed president Raphael Bostic, who similarly advocates for patience amidst uncertain economic terrain.

Bostic underscores the inevitability of occasional setbacks on the path towards achieving the Fed's 2% inflation target, urging stakeholders to adopt a nuanced perspective that accounts for both short-term fluctuations and long-term objectives.

Market Sentiment and Investor Reaction

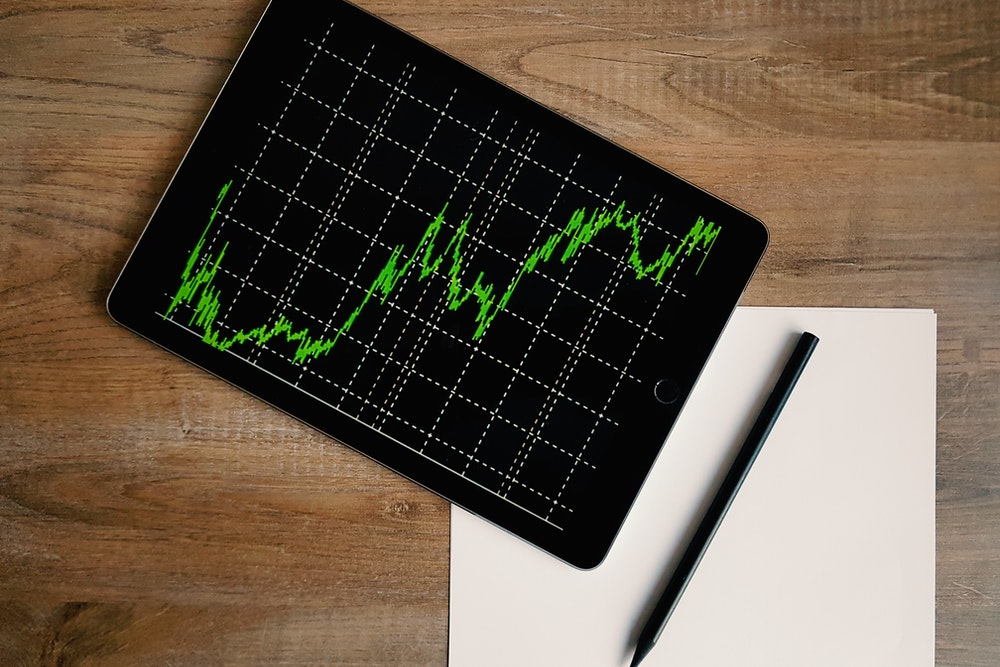

Freepik | pressfoto | Market sentiment changes highlight the challenge of interpreting real-time economic data.

The fluctuating sentiment within financial markets underscores the complexity of interpreting economic data in real-time. Initially, market expectations leaned towards a more aggressive stance, with investors betting on six rate cuts starting in March.

However, subsequent recalibrations reflect a more tempered outlook, with expectations now aligned towards three cuts commencing in June. This fluidity underscores the inherent unpredictability of economic forecasting and the importance of adaptability in navigating volatile market conditions.

Looking Ahead: A Path Forward

As stakeholders grapple with evolving economic dynamics, the insights offered by Loretta Mester and her colleagues provide valuable guidance in navigating uncertain terrain. While challenges persist, a nuanced understanding of economic fundamentals coupled with a patient and prudent approach to monetary policy can pave the way for sustained growth and stability.

As the Federal Reserve continues to monitor developments closely, stakeholders can take solace in the knowledge that proactive measures are being undertaken to safeguard the long-term prosperity of the economy.