Are you thinking of shaking things up in your life? Whether you are pondering a cross-country move, diving into a new entrepreneurial venture, or dreaming of a gap year to explore undiscovered terrains, life’s big shifts need more than just enthusiasm - they need a solid financial foundation.

Now, let’s go ahead and talk about the tell-tale signs that your pockets and plans are synced up for the upcoming roller-coaster.

Your Career Vision Is Realistic

Now, let’s get a bit introspective. Beyond the numbers and bank statements, where do you see yourself in the next decade? Whether you are a fresh grad, a mid-career maverick, or someone considering a second act, having a long-term career vision is pivotal.

Andrea / Pexels / If you are financially prepared, change (be it quitting your current job or starting your own business) can be worth doing.

This vision can guide your financial decisions. It tells you whether you should save for that MBA, invest in that startup, or perhaps set aside funds for a future freelancing phase. Your career compass, combined with financial wisdom, can lead to wonders.

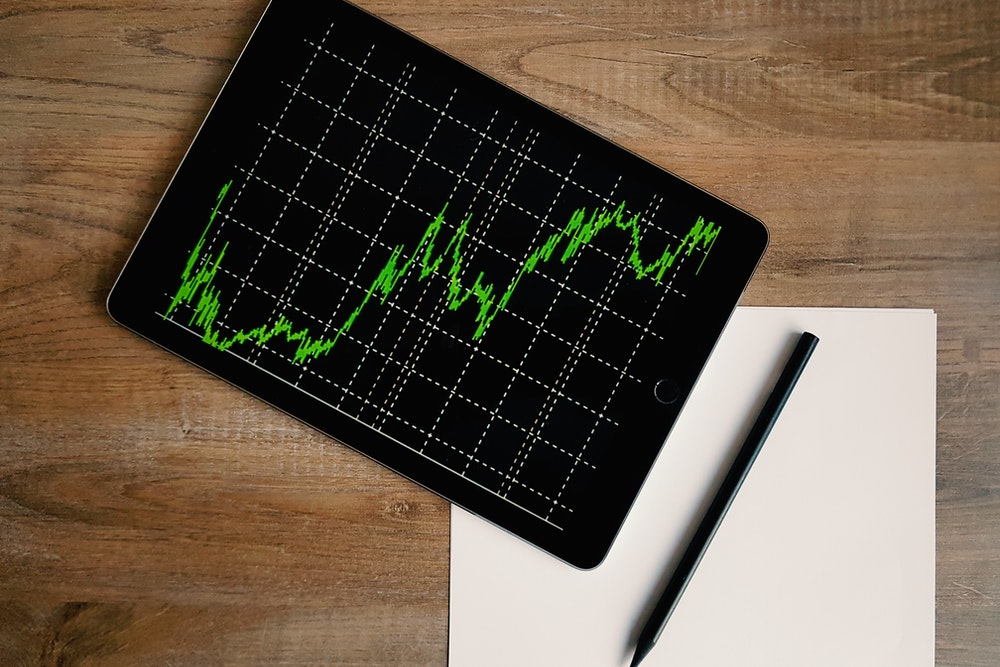

Financial Stability

Let’s kick off our list with the heart of the matter: Financial Stability. But what does that term really mean? It is not about flaunting a luxury car or splurging on exotic vacations (though if you can afford it, why not?). Stability is more about the nitty-gritty: The boring, day-to-day stuff.

Do you have a clear-cut budget? Are you setting aside a part of your earnings for the future? Perhaps you are even dipping your toes in the investment pool. These are the foundations of a steady financial future. If you have got a grasp on these, you are on the right track.

Andrea / Pexels / If you are looking for a change, make sure that you are financially stable enough to take the risk.

No Debts? Take a Bow!

Debts are the chains that often hold many of us back. If you have managed to break free, give yourself a pat on the back. Being debt-free is a monumental sign that you have got a handle on your finances.

Without the looming shadow of debt repayments, you have one less thing to worry about when navigating change. Plus, a debt-free status often comes with a better credit score, making any future financial endeavors smoother.

A Safety Net of Savings

Alright, imagine this. You are at a circus, watching a trapeze artist swinging high above – no net below. Pretty nerve-wracking, right? The same goes for making significant life shifts without savings. Your savings act as that safety net, ready to catch you if things do not swing your way.

Tira / Pexels / Before you embrace the change, make sure you have enough savings to back you up.

The golden rule? Have about 3-6 months of your expenses tucked away. It is not just a buffer. Rather, it is your ticket to peace of mind.

Mortgage Matters

Lastly, understanding your mortgage situation is vital for those with bricks and mortar to their name. Owning a home is a significant financial milestone, but it comes with its set of responsibilities.

Are you on top of your repayments? Have you considered refinancing for a better deal? A secured mortgage not only ensures you have a roof over your head but also adds a feather to your cap when it comes to financial readiness.